Discover how ERA in medical billing improves claim processing, automates payment reconciliation, and enhances revenue cycle efficiency. Learn its key benefits today!

Picture a busy clinic where the billing manager’s desk is covered with stacks of paper Explanation of Benefits (EOBs). Every day, they spend hours manually entering payment details, fixing errors, and trying to read unclear notes from different insurance companies. It’s a frustrating and time-consuming process.

Now imagine the same clinic where payments are processed automatically, adjustments are easy to understand, and everything runs smoothly. That is the power of Electronic Remittance Advice (ERA) in medical billing.

In this blog, we will explain what ERA is in medical billing and how it helps healthcare providers streamline payment processing and reduce delays.

What is ERA in medical billing?

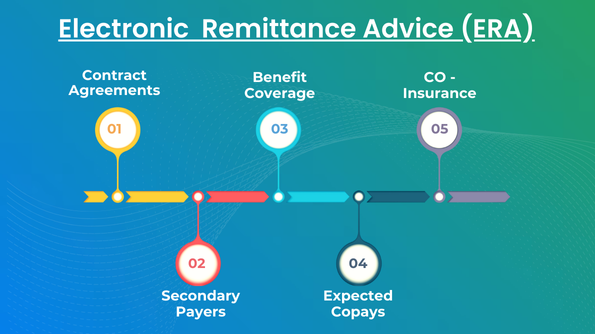

An Electronic Remittance Advice (ERA) is an electronic equivalent of the 835 file that contains significant payment information such as claim status and benefit coverage. ERAs are sent by insurance companies to medical providers to inform them of how claims were processed.

According to federal regulation, all HIPAA-covered entities, including insurance companies, healthcare providers, and clearinghouses, are required to implement ERAs for electronic transactions in order to provide standardization and efficiency in payment processing.

ERAs are transmitted in a HIPAA-compliant ANSI X12 5010 standard. Providers that enroll for ERAs will not receive paper remittance advice in the mail.

To learn more about the latest regulations and best practices for implementing ERA, you can check out this comprehensive guide by revmaxx.

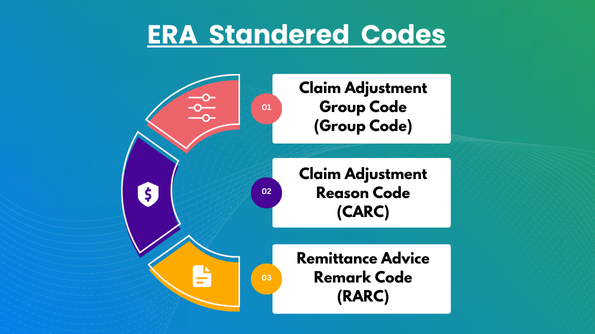

Standard Codes Used in ERA to Identify Adjustments

Healthcare providers can create an Explanation of Benefits (EOB) as an electronic file, typically in the 835 format, and download the ERA 835 file from the clearinghouse.

Insurance firms put expansive claim data into an ERA, including claim status and payment detail. This allows providers to check and settle any claim problems effectively.

An ERA also describes why payment adjustments were made and the associated amounts. Adjustments can be listed by claim or at the provider level.

Three standard codes exist to describe adjustments in an ERA:

- Claim Adjustment Group Code (Group Code)

- Claim Adjustment Reason Code (CARC)

- Remittance Advice Remark Code (RARC)

Claim Adjustment Group Codes (Group Code)

Claim Adjustment Group Codes (Group Codes) show who is responsible for a claim adjustment in the Explanation of Benefits (EOB). Each code consists of two letters.

There are five types of Claim Adjustment Group Codes:

- CO (contractual obligation): adjustments required by the provider’s contract with the payer.

- CR (Corrections and Reversal): Used for claim corrections or payment reversals.

- OA (other adjustment): adjustments that don’t fit into other categories.

- PI (Payer-Initiated Reductions): adjustments made by the insurance company.

- PR (Patient Responsibility): The portion of the bill the patient must pay.

Important Tip: Medicare patients can only be billed if Group Code PR is used in the adjustment.

Claim Adjustment Reason Codes (CARCs)

Claim Adjustment Reason Codes (CARCs) describe the reason why a healthcare provider was billed differently from what the insurance company paid.

They are an industry standard method of communicating claim adjustments and assisting providers in understanding why a payment was denied or reduced.

The primary function of CARCs is to provide a distinct explanation for any variation, either because of billing mistakes, limits of coverage, or other elements influencing the payment of the claim.

Remittance Advice Remark Codes (RARCs)

Remittance Advice Remark Codes (RARCs) provide supplementary information regarding an adjustment on payment already described in a Claim Adjustment Reason Code (CARC). They also deliver valuable information concerning the processing of a claim.

Each RARC relates to a certain message enumerated in the Remittance Advice Remark Code List, which provides better clarity of claim adjustments for healthcare providers.

levels/segments of an ERA

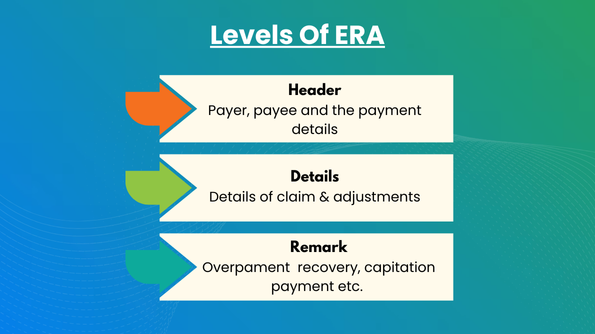

An Electronic Remittance Advice (ERA) is organized into three main parts:

- Header: This is like the introduction.

- Details: This section provides more specific information.

- Remark: This part includes any additional comments or notes.

Inside each of these parts, you will find smaller pieces of information called segments. These segments help organize the ERA and make it easier to understand. You can see how it all fits together in the table below.

| Header | ||

The header section includes important information like:

|

The details section gives you a clear picture of the claim and any adjustments made. It includes:

|

Lastly, the trailer section includes information about:

|

How ERA Assists Providers in Payment Processing?

With the use of high-tech technology in healthcare, providers and patients both benefit from improved efficiency and accuracy.

Electronic Remittance Advice (ERA) has simplified the process of payment, which is easier for healthcare providers to deal with claims and payments with insurance firms.

The following are some of the most important advantages of ERAs and how they assist providers:

Minimizes Manual Processes

Manual payment procedures involve processing paper Explanation of Benefits (EOBs), which may be time-consuming and subject to errors or delay.

With Electronic Remittance Advice (ERA), this is a process that can be automated. Payments and claim information are electronically sent, lessening the occurrence of manual data entry and missing documents.

Healthcare professionals can simply process ERAs within their practice management system, automate posting of payments, and post adjustment codes to patient accounts. This saves time, reduces costs, and enables staff to concentrate on more critical activities.

Fast and Accurate Payments

Electronic Remittance Advice Absolutely accelerates the payment process and allows for quicker and more precise payments than paper-based transactions.

With increased processing speed, health care providers can enhance collections, decrease claim denials, and minimize costs associated with paper.

Improved efficiency and accuracy assist healthcare practices in managing their finances smoothly and enhance productivity on the whole.

Cuts Administrative Costs

Running billing and payment operations electronically using Electronic Remittance Advice (ERAs) removes much of the effort from healthcare personnel. That leaves them more time to focus on patients rather than paper.

ERAs also save on errors people might make, and that means insurance claims are denied or rejected less often. This smooths things out and gets the job done more efficiently.

Improved Patient Satisfaction

ERAs simplify the billing process and make it more transparent for patients. They ensure timely payment processing and accuracy, and they clearly explain to patients what they are being charged for.

This transparency creates trust and makes patients more satisfied with the service they receive. It also reinforces the patient-provider relationship, which is particularly crucial for long-term care and satisfaction.

Enhanced Workflow Efficiency

ERAs interact seamlessly with the software employed to process payments, hence making it all simpler.

They reduce errors and workload for billing personnel by avoiding the need to key in details into various systems.

ERAs enable healthcare practices to receive payment data in real-time, thus allowing them to monitor claims, resolve any issues promptly, and maintain everything smooth.

Optimized Revenue Management

ERAs help quickly spot any mistakes in payments from insurance companies, making sure healthcare providers get the right amount of money back.

They make it easier to keep track of where claims are in the process and to follow up on claims that have been denied or rejected. This helps manage money better and improves financial results.

By fixing payment problems right away, healthcare providers can do better financially and keep their finances in good shape.

The Final Thoughts

ERAs in medical billing represent a giant step for the healthcare industry in adopting digital technology. They have become an integral part of healthcare providers because they make payment processing easier, more accurate, less paperwork-intensive, and easier to administer revenue.

In the end, ERAs allow healthcare providers to earn more money and appease patients by receiving payments accurately and on time.

Discover how our solutions can transform your practice—explore our services here.